After securitization, a 2-year lockout period begins, and defeasance is allowed afterward.

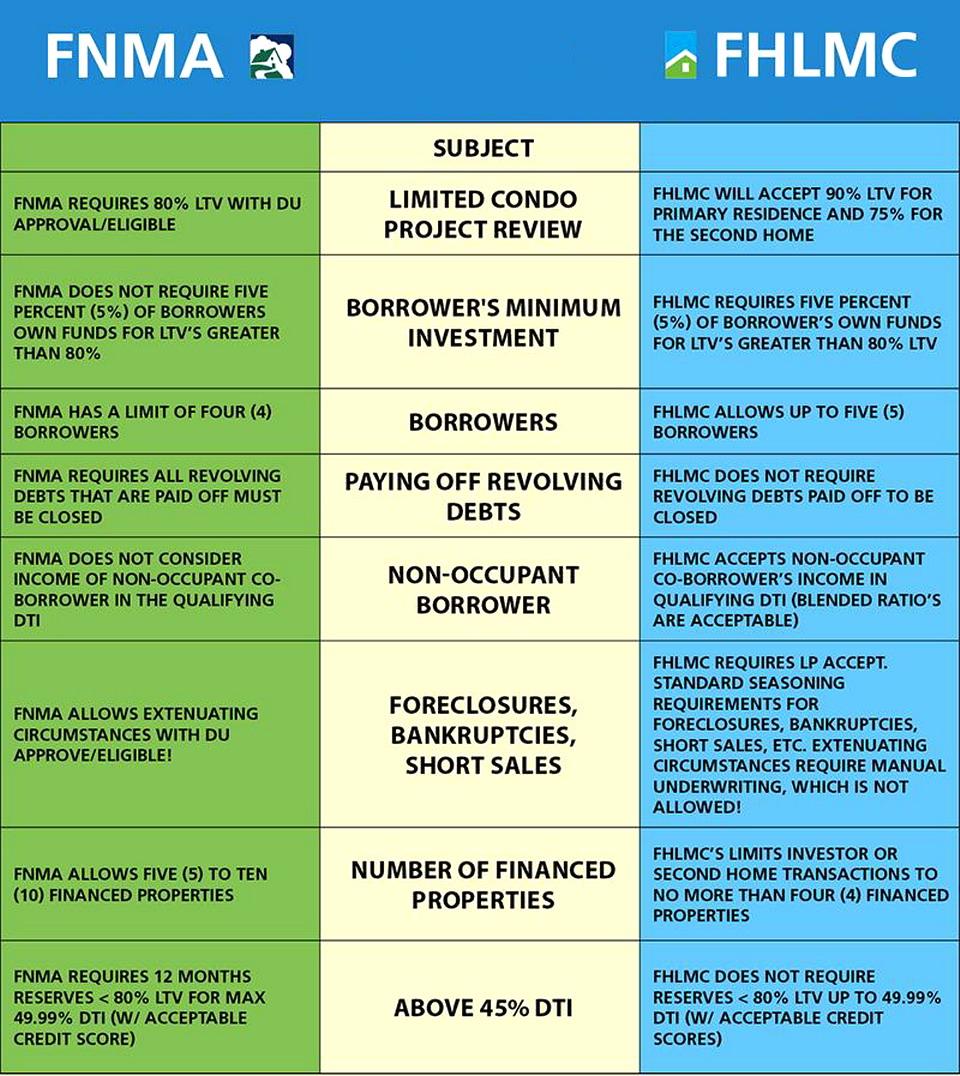

Prepayment: Yield maintenance is permitted until securitization. Interest Options: Interest-only options available Recourse: Non-recourse (standard carve-outs apply) Rate locks: Yes, both early and extended available Loan Term: 5-30 year fixed-rate terms available Loan Size: $1 million with no upper limit While Freddie Mac loan terms vary somewhat between products, general terms include: General Terms for Freddie Mac Apartment Loans In addition, since many Freddie Mac loans are securitized and sold to investors, borrowers will often have to engage in defeasance if they want to prepay their loan.

Much like its sister company, Fannie Mae ®, Freddie Mac offers non-recourse, 30-year fixed-rate loans with up to 80% leverage. While Freddie Mac loans are a great option for market-rate properties, they often offer significant advantages to borrowers attempting to obtain financing for affordable properties, such as HUD Section 8 properties or those being funded with the Low Income Housing Tax Credit ( LIHTC).ĭespite the incredible benefits of Freddie Mac multifamily financing, it can be somewhat difficult to obtain Freddie Mac typically puts a strong emphasis on the financial strength of potential borrowers, as well as considering their multifamily real estate experience. In 2017, Freddie Mac financed $73.2 billion in multifamily and apartment loans. 2021 Freddie Mac Multifamily Loan Options

0 kommentar(er)

0 kommentar(er)